Explore how UPI revolutionized digital payments in India by 2025. This case study by aspiring product manager Malika compares the top 8 UPI players—PhonePe, Google Pay, Paytm, Amazon Pay, BharatPe, Mobikwik, BHIM, and WhatsApp Pay—along with insights on areas for improvement and innovation.

👋 Introduction

Hi, I’m Malika – an aspiring product manager who’s passionate about how tech products shape everyday life. One of the biggest success stories in India today is UPI (Unified Payments Interface). In this case study, I’ll walk you through UPI’s rise, how the top players compete, and where they can grow next – all from a product lens.

📈 1. UPI in 2025 – How Big Has It Become?

India: UPI processes around 600 million transactions daily. In May 2025 alone, it handled over 18.6 billion transactions. That’s a testament to its speed, reliability, and wide acceptance.

Global: UPI is now accepted in 12+ countries, including the UAE, Nepal, and France. Indians abroad can pay just like they do at home.

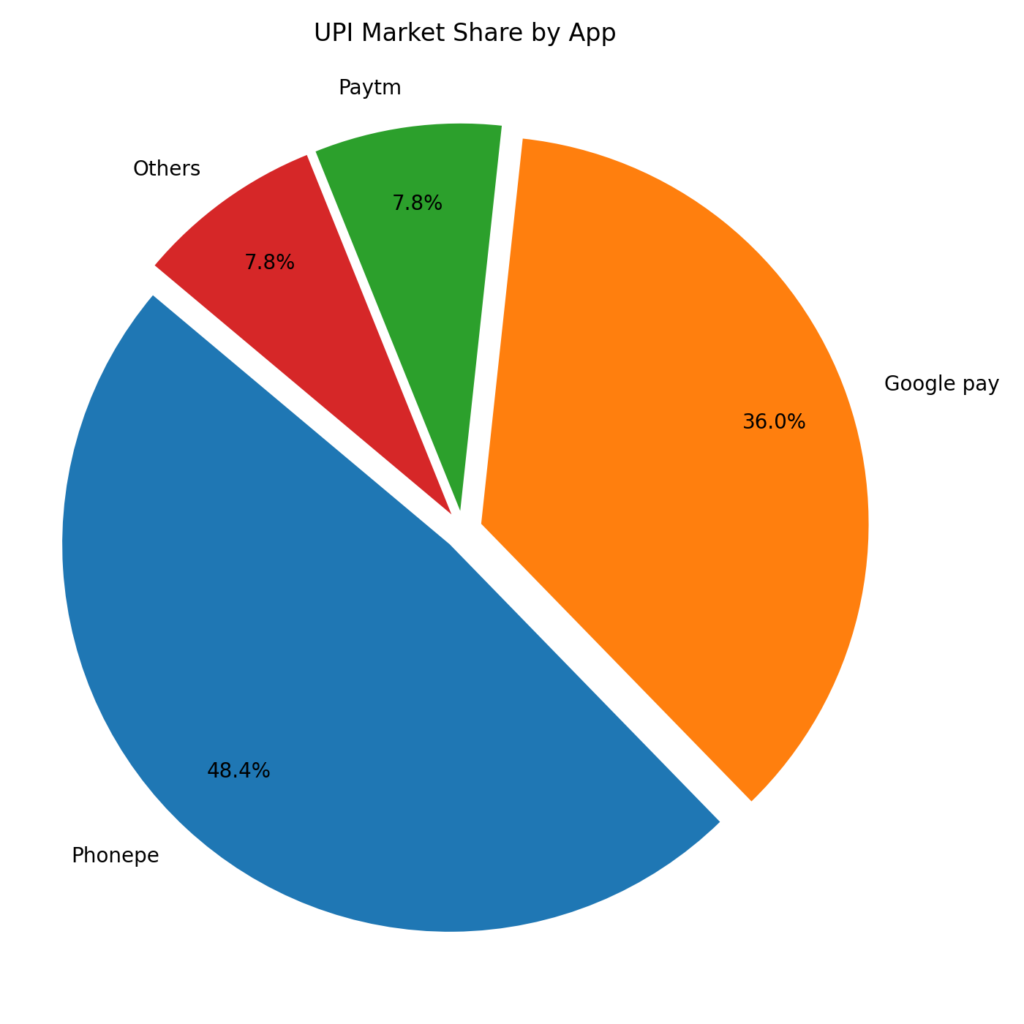

📱 2. Which UPI Apps Are Most Popular?

India’s UPI landscape is led by a few giants, but others serve unique audiences:

PhonePe – 47.8% market share, 490M+ users

Google Pay – ~37% share, 67M+ Indian users

Paytm – 89M+ monthly active users

BHIM – Government-backed, trusted in rural areas

WhatsApp Pay – Low share but big future due to huge install base

Amazon Pay, BharatPe, Mobikwik – Focused on specific user segments like shoppers, merchants, and rewards lovers

🆚 3. Comparing the Top 8 UPI Players (2025)

| App | Strengths | Areas to Improve | 5-Year Focus | UX Rating | Trust Level | Merchant Support |

|---|---|---|---|---|---|---|

| PhonePe | Massive reach, full ecosystem | App feels heavy, cluttered UI | Cleaner design, better financial tools | ⭐⭐⭐⭐☆ | ⭐⭐⭐⭐☆ | ⭐⭐⭐⭐⭐ |

| Google Pay | Simple UI, great rewards | Slower feature rollout | Personalization, smart features | ⭐⭐⭐⭐⭐ | ⭐⭐⭐⭐☆ | ⭐⭐⭐☆ |

| Paytm | Full suite (wallet, UPI, recharge) | Complex interface | Streamlined UX, focused branding | ⭐⭐⭐☆ | ⭐⭐⭐☆ | ⭐⭐⭐⭐ |

| Amazon Pay | Smooth on Amazon, good offers | Weak outside Amazon ecosystem | Expand use cases, bill payment push | ⭐⭐⭐☆ | ⭐⭐⭐⭐ | ⭐⭐☆ |

| BharatPe | Strong merchant base | Low consumer traction | Better UX for individuals | ⭐⭐☆ | ⭐⭐⭐ | ⭐⭐⭐⭐ |

| Mobikwik | Youth-focused, simple UI | Weak UPI recall | Gamified savings, Gen Z appeal | ⭐⭐☆ | ⭐⭐☆ | ⭐⭐☆ |

| BHIM | Simple and reliable | Outdated UI, low flexibility | Redesign, voice and regional support | ⭐⭐☆ | ⭐⭐⭐⭐☆ | ⭐⭐☆ |

| WhatsApp Pay | Built-in, easy access | Limited UPI capabilities | Merchant payments, broader rollout | ⭐⭐⭐☆ | ⭐⭐⭐⭐ | ⭐⭐☆ |

🛠️ 4. Product Manager Lens – Key Opportunities

Here’s what I’d suggest each platform focus on in the next 5 years:

Adaptive UI/UX – Apps should simplify based on user behavior and device type.

Voice + Vernacular Support – Important for Tier 2/3 cities and elderly users.

Micro-Credit and Pay-Later – Financial inclusion through instant, small-credit tools.

Offline Payment Options – Enable payments via Bluetooth, NFC, or QR caching.

Financial Coaching Tools – Use data to offer smart budgeting and payment nudges.

🔮 5. The Future of UPI (2025–2030)

Here’s where the ecosystem is headed:

Voice-first Payments – Speak your payment instead of typing.

UPI Credit Stack – Integrated EMI and pay-later options.

Gamified Finance – Make saving money feel like winning a game.

Offline UPI 2.0 – Internet-free payments for rural India.

AI-Powered Finance Assistants – Budgeting, bill reminders, insights—all in-app.

✅ Conclusion

UPI is no longer a payment method—it’s a way of life in India. As a future product manager, I see exciting opportunities to build apps that are more intuitive, inclusive, and fun.

“A product that wins is one that understands its users deeply and keeps evolving with them.”

Thanks for reading my case study! 😊

Follow my journey on Instagram @pmjourneywith_Malika or visit malikasingal.com for more insights.

📥 Prefer a downloadable version? Click the button below to download this full UPI Case Study as a PDF and keep it for future reference, interviews, or your PM learning journey